PropNex Picks

|November 04,2025Boomers To Gen Z: The Changing Faces Of Homeownership

Share this article:

Once, owning a home meant security. Today, it might mean strategy, freedom - or a dream that feels just out of reach.

Homeownership has always been at the heart of the Singapore dream - a symbol of stability, progress, and pride. Yet, its meaning has evolved through the decades. For earlier generations, it was about stability and family; today, it's equally about flexibility, wealth-building, and lifestyle. This evolution reflects the essence of our Property Wealth System (PWS) - that property is more than shelter; it's a structured path toward financial growth.

In Singapore, the story of homeownership is inseparable from the evolution of the HDB. What began in the 1960s as simple slab blocks offering affordable shelter has transformed into integrated, smart communities designed for modern living. Each decade has reflected a new chapter of progress - from necessity to aspiration, from uniform flats to distinctive neighbourhood identities.

Boomers grew up in a time of rebuilding and nationhood. The HDB's first two decades (1960-1980) saw experimentation with slab blocks, point blocks, and precinct layouts that balanced density with liveability. Early estates such as Queenstown and Toa Payoh became showcases of modern planning under the Home Ownership for the People Scheme (1964) - transforming rental tenants into proud homeowners.

These first-generation flats were simple but symbolic, focused on essential shelter and improving living standards. Shared spaces like void decks and markets nurtured a close-knit kampung spirit, fostering community pride. CPF housing financing made ownership accessible, and prices - often just a few thousand dollars for a small flat - were within reach for many working families.

Mindset: Homeownership was about survival, stability, and nation-building - a roof over one's head and a legacy for the next generation.

Affordability: Prices were low relative to income, and CPF use made ownership achievable. Upgrading wasn't yet a concept; the goal was simply to own.

Preferred homes: 3-room or 4-room HDB flats dominated the landscape, providing functional living spaces with community spirit. Some financially secure families were early adopters of private landed homes, marking the beginning of Singapore's diverse housing mix.

Key takeaways: This era laid the foundation for today's property progression mindset - viewing a home not just as shelter but as a vehicle for generational wealth.

Gen X came of age during Singapore's economic expansion. As incomes grew and financial literacy improved, many homeowners began their first portfolio restructures, upgrading strategically to grow equity and position for appreciation - echoing the early roots of PWS thinking.

The 1990s saw the rise of Executive Condominiums (ECs, introduced in 1995), bridging public and private housing. Towns like Ang Mo Kio, Tampines, and Bishan matured into self-sufficient neighbourhoods with schools, malls, and amenities, reflecting elevated lifestyles. Private projects such as Pine Grove and Mandarin Gardens became aspirational symbols of success.

Mindset: Homeownership evolved from a basic need into a symbol of success and aspiration. For many, upgrading was not just about comfort but also about progress - financial, social, and personal.

Affordability: Dual-income families could still afford to upgrade, though prices began climbing. ECs became a key stepping stone for middle-class ambition.

Preferred homes: Private condos, ECs, and larger resale HDBs in mature estates dominated this era.

Key takeaways: For Gen Xs, property symbolised achievement and mobility - a way to move up socially, financially, and geographically within Singapore's growing urban landscape.

Millennials entered a more complex market shaped by urbanisation, policy shifts, and cooling measures. By this era, many homeowners began restructuring portfolios - upgrading strategically to enhance equity and future potential, aligning with PWS principles of property progression.

The 2000s and 2010s brought the Build-to-Order (BTO) system, more designed-forward HDB towns like Punggol and Sengkang, and a series of cooling measures, such as ABSD in 2013. Homes grew smaller but more connected, blending lifestyle and convenience. With rising prices, Millennials had to be more calculative - balancing passion with prudence.

Mindset: For Millennials, homeownership remains a key life goal, but it's approached with greater strategy and flexibility. They view property not just as a milestone of adulthood but as a calculated investment. Many are open to concepts like rentvesting or owning smaller spaces that align with urban convenience.

Affordability: With the widening income-to-price gap, affordability became a major challenge. Many Millennials rely on housing grants, joint applications, or family support to enter the market. Delayed marriage trends also mean delayed BTO eligibility, prompting some to turn to resale HDBs or smaller private condos instead. Despite these hurdles, their determination to own remains strong - often driven by a desire for independence and financial security.

Preferred homes: BTOs, resale flats, and compact private condominiums near transport hubs and lifestyle amenities define this generation's choices.

Key takeaway: For Millennials, property is both a strategy and a statement - a balance between living well today and investing for tomorrow.

Gen Z is growing up in an era of instant data and infinite choice. PropTech tools, AI-driven market insights, and digital communities influence how they perceive value. Rising costs make ownership seem distinct, yet the dream persists - transformed into digital-first, experience-driven aspirations.

Co-living concepts reflect Gen Z's preference for flexibility, while fractional ownership platforms make investing possible without full ownership. They prioritise sustainability, mobility, and tech integration - aligning their homes with lifestyle rather than legacy.

Mindset: Curious and analytical, they approach property as part of a broader financial ecosystem. Data-backed insights guide decisions.

Affordability: Slower income growth and rising prices push them towards alternative paths - REITs, shared spaces, and co-investments.

Preferred homes: Sustainable, tech-integrated, and adaptable spaces top their list - homes that can evolve with changing needs, support hybrid work, and align with eco-conscious values. Compact, smart apartments or co-living units with shared amenities suit their flexible lifestyles.

Key takeaways: For Gen Zs, real estate is redefined - ownership blends digital intelligence, lifestyle flexibility, and strategic planning inspired by systems like PWS.

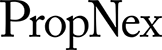

The property market has undergone an extraordinary transformation since the 1990s. Average resale condo prices have surged from around $1,090,000 to over $2,000,000 by 2025, while HDB resale flats have grown from roughly $70,000 to $650,000. These numbers tell a larger story - the increasing complexity and sophistication of property wealth-building, as well as the rising cost of land scarcity.

HDB (Red), Condo (Blue)

The widening gap between public and private housing illustrates how wealth creating through property has become both more challenging and more data-driven. For future buyers, having the right strategy will be crucial - from timing their market entries to managing leverage and restructuring portfolios for sustained growth.

Observation: What was once a straightforward milestone is now a strategic financial pursuit, requiring insight and timing.

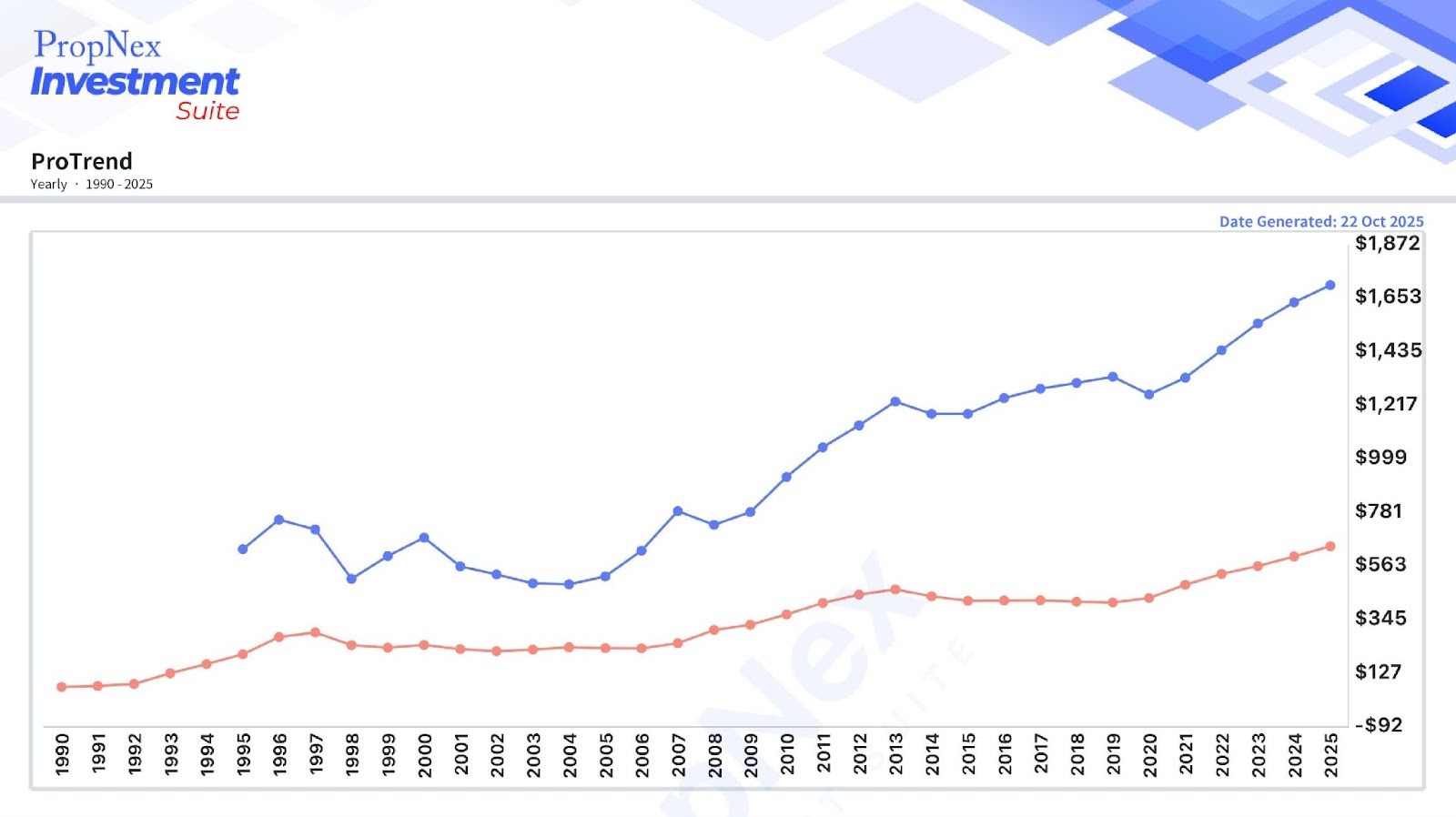

Analysis: Across all flat types, HDBs continue to appreciate - proving that public housing remains both a social pillar and a wealth vehicle. Smaller units gain value from limited supply and lifestyle demand, while larger flats retain appeal for family stability.

2R (Blue), 3R (Red), 4R (Orange), 5R (Green), Executive Apartment & Maisonette (Brown)

A society evolves, success is being redefined. Financial freedom, sustainability, and experiences increasingly shape aspirations. With the revamp of Singapore's northern neighbourhoods and the upcoming RTS Link to Johor Bahru, improved cross-border access could inspire younger Singaporeans to explore Johor's property market - offering affordability and lifestyle flexibility.

Beyond Gen Z lies Gen Alpha (born after 2013) - digital natives raised in AI-driven smart cities. Their view of "home" may merge the physical and digital, blending virtual property, sustainable architecture, and hyper-connectivity. Yet, regardless of technology, the goal remains - stability, belonging, and opportunity.

If every generation redefines success, what will "home" mean to the next - and the ones after?

From Boomers who built Singapore's housing foundations to Gen Z shaping a digital property future - and Gen Alpha poised for AI-driven living - one thing remains constant: the desire for a place to call home.

Each generation faces new realities, policies, and priorities, but the underlying dream persists. What began as survival evolved into strategy - from securing a roof to leveraging property as a lifelong wealth tool. Through systems like PWS, that journey continues - empowering future generations to progress, restructure, and grow their property portfolios with purpose.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.